How Medicare Supplement Can Improve Your Insurance Protection Today

In today's complicated landscape of insurance policy options, the role of Medicare supplements stands out as a crucial component in boosting one's coverage. As individuals browse the intricacies of health care strategies and look for comprehensive defense, understanding the nuances of additional insurance coverage comes to be significantly crucial. With a concentrate on connecting the spaces left by traditional Medicare strategies, these additional choices offer a customized method to conference specific requirements. By checking out the advantages, coverage options, and expense factors to consider connected with Medicare supplements, individuals can make informed choices that not only bolster their insurance policy coverage yet likewise provide a sense of protection for the future.

The Essentials of Medicare Supplements

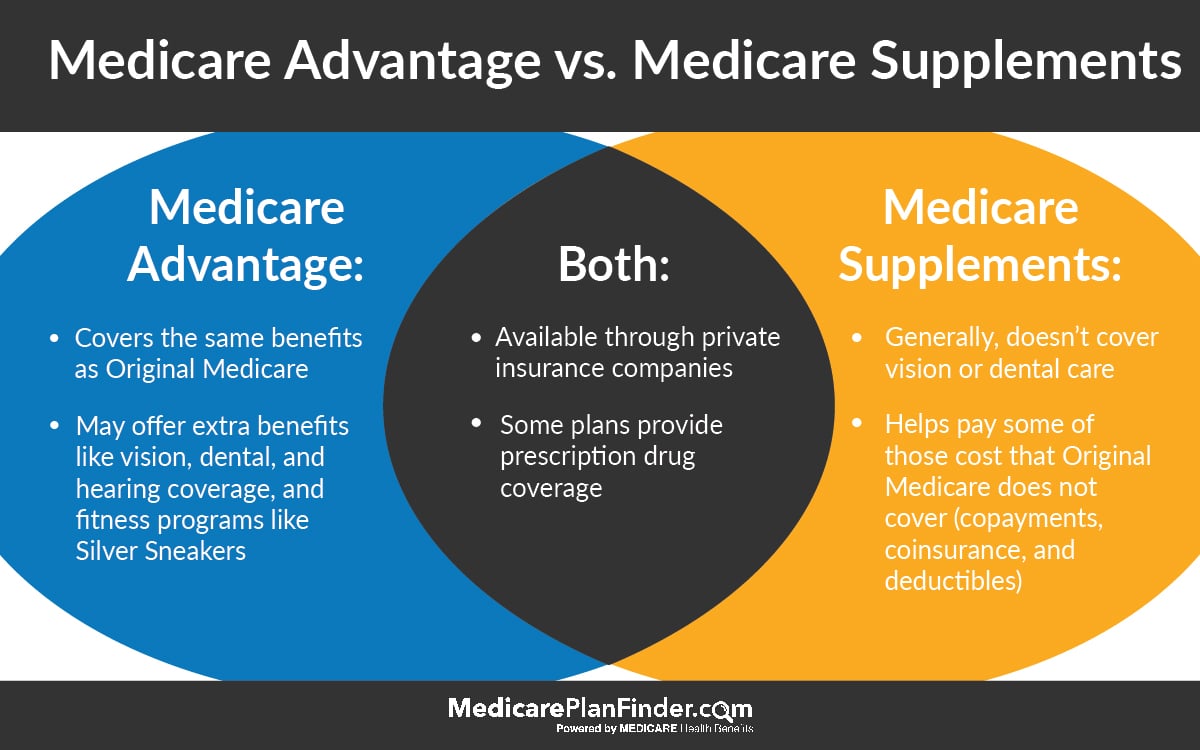

Medicare supplements, also called Medigap strategies, provide additional coverage to fill up the spaces left by original Medicare. These supplemental plans are provided by exclusive insurance provider and are developed to cover expenses such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Part A and Component B. It's necessary to note that Medigap strategies can not be used as standalone policies but work alongside initial Medicare.

One trick aspect of Medicare supplements is that they are standardized across the majority of states, offering the same basic benefits no matter the insurance provider. There are 10 various Medigap plans identified A via N, each giving a different level of insurance coverage. For circumstances, Plan F is among the most extensive choices, covering mostly all out-of-pocket expenses, while other strategies might provide extra restricted protection at a reduced premium.

Understanding the basics of Medicare supplements is essential for people coming close to Medicare eligibility that desire to improve their insurance policy protection and decrease prospective financial concerns connected with healthcare costs.

Comprehending Protection Options

When taking into consideration Medicare Supplement prepares, it is essential to comprehend the various protection choices to make certain detailed insurance security. Medicare Supplement intends, additionally recognized as Medigap policies, are standard throughout the majority of states and labeled with letters from A to N, each offering varying levels of protection - Medicare Supplement plans near me. Furthermore, some plans may use coverage for services not consisted of in Initial Medicare, such as emergency care during international traveling.

Advantages of Supplemental Program

Understanding the substantial benefits of additional strategies can brighten the worth they offer individuals seeking boosted healthcare insurance coverage. One crucial advantage of supplemental plans is the economic security they provide by assisting to cover out-of-pocket costs that initial Medicare does not completely pay for, such as deductibles, copayments, and coinsurance. This can lead to significant financial savings for policyholders, especially those that require frequent clinical services or therapies. In addition, supplementary plans provide a more comprehensive array of insurance coverage alternatives, consisting of accessibility to medical care service providers that may not approve Medicare project. her comment is here This flexibility can be critical for individuals that have details health care needs or choose certain medical professionals or experts. Another benefit of extra strategies is the ability to travel with satisfaction, as some strategies provide protection for emergency situation medical solutions while abroad. Generally, the advantages of additional plans contribute to an extra more helpful hints detailed and customized method to health care insurance coverage, ensuring that individuals can get the care they need without facing overwhelming financial burdens.

Expense Factors To Consider and Financial Savings

Offered the monetary safety and broader insurance coverage alternatives offered by supplemental plans, a crucial facet to consider is the cost factors to consider and possible cost savings they provide. While Medicare Supplement plans call for a regular monthly costs in enhancement to the basic Medicare Part B costs, the benefits of lowered out-of-pocket expenses frequently surpass the included expense. When examining the price of extra plans, it is important to contrast costs, deductibles, copayments, and coinsurance across various strategy types to identify the most cost-effective alternative based on specific healthcare needs.

By choosing a Medicare Supplement strategy that covers a greater percent of healthcare expenses, individuals can reduce unforeseen expenses and spending plan extra effectively for medical care. Ultimately, investing in a Medicare Supplement plan can provide important monetary defense and tranquility of mind for recipients looking for comprehensive coverage.

Making the Right Selection

Selecting one of the most ideal Medicare Supplement plan necessitates careful consideration of specific continue reading this medical care demands and economic scenarios. With a range of plans available, it is important to examine elements such as protection options, premiums, out-of-pocket prices, provider networks, and total worth. Comprehending your current health standing and any kind of expected clinical demands can assist you in selecting a plan that supplies detailed protection for services you might call for. Furthermore, examining your budget constraints and contrasting premium expenses amongst various plans can aid guarantee that you select a strategy that is budget-friendly in the long-term.

Final Thought